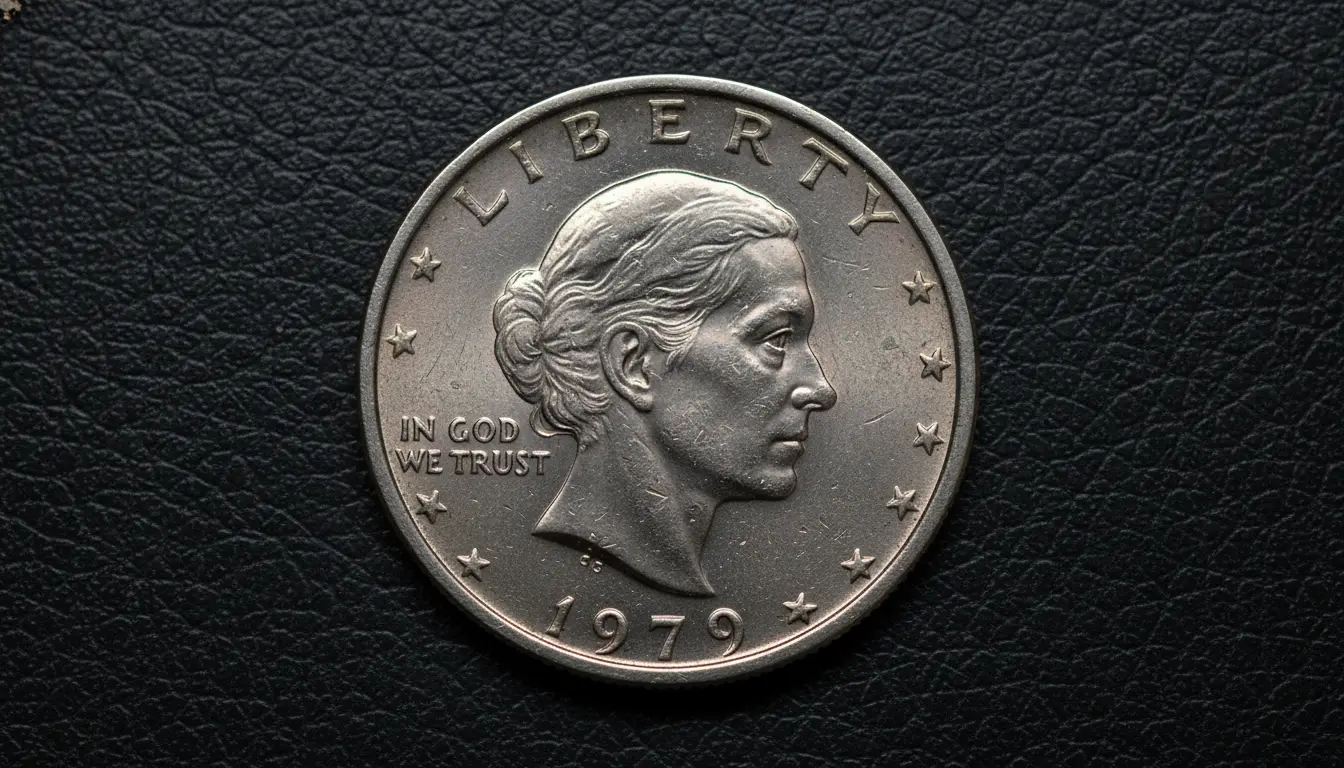

On a quiet Saturday morning in suburban Melbourne, Eleanor Thompson carefully unpacked an old box of coins inherited from her late grandfather. As a casual collector, she routinely checks the value of her finds online but was stunned when she discovered one particular coin could be worth more than a year’s salary. Among the loose change lay a 1981 Susan B. Anthony dollar—a coin notoriously overlooked—that experts now say could fetch up to $880,000 in rare cases.

What began as a routine appraisal has turned into a fascinating story about the hidden worth and historic significance of coins once deemed ordinary. Eleanor’s discovery highlights the sudden surge of interest in these decades-old coins, sparking excitement within numismatic communities across Australia and beyond.

What Is Happening

The 1981 Susan B. Anthony dollar, a U.S. coin not widely circulated in Australia, has recently seen a dramatic rise in value among collectors and investors.

Rare editions, errors, and uncirculated versions of this coin are being auctioned for sums far above their face value.

This surge is driven by renewed global attention on vintage coins and increasing demand within Australian collectors’ circles eager to diversify their collections.

Discussions about this coin’s value have intensified on social platforms and at coin shows nationwide, prompting financial advisors to reconsider the potential of numismatics as part of alternative investments.

Why This Matters to You

For many Australians, the rise in the Susan B. Anthony dollar’s value is a reminder that everyday possessions can sometimes hold unexpected wealth.

Families sorting through inherited items may find themselves with valuable collectibles needing expert appraisal.

Financially, this indicates growing interest in alternative assets beyond traditional shares or property, offering another avenue for saving or investment.

Practically, understanding coin values can prevent accidental disposal of rare items, thereby preserving cultural history and individual wealth.

Government or Official Response

The Australian Treasury Department released a statement this week responding to the rising interest in vintage foreign coins.

“We acknowledge the increasing engagement of Australians with numismatic assets as part of broader financial literacy efforts. While these assets can offer unique value, individuals should seek professional guidance before making investment decisions based on collectible items,” said Treasury spokesperson Dr. Helen Marlow.

“We encourage responsible collecting and urge stakeholders to verify valuations through accredited channels to avoid misinformation.”

Expert or Analyst Perspective

“This change will reshape how households plan their finances over the next decade,” said a senior policy analyst.

Senior currency expert Jonathan Marks explains that the Susan B. Anthony dollar’s rarity is primarily linked to minting errors and low circulation in specific editions.

Marks notes that increased global interest in nostalgia items has caused values to skyrocket for coins once considered mundane.

“Collectors’ awareness combined with limited supply results in exponential price growth,” he said.

Experts caution, however, that not all 1981 Susan B. Anthony dollars possess such high value—only rare variants or coins in perfect condition qualify.

Key Facts and Figures

The highest estimated price for an exceptional 1981 Susan B. Anthony dollar reportedly reached $880,000 in a recent private auction outside of Australia.

Most regular coins from that batch are valued between $5 and $30 on the collectors’ market.

Coin grading conditions vary from ‘Good’ to ‘Mint State,’ with the rare ‘Proof’ or ‘Error’ coins becoming key items in auction houses.

| Coin Type | Condition | Estimated Value (AUD) |

|---|---|---|

| Regular Circulated | Good to Fine | 5 – 30 |

| Uncirculated | Mint State | 150 – 900 |

| Error Coin (Double Strike) | Proof | 50,000 – 880,000 |

Public Reaction and Broader Impact

Many Australian coin collectors have expressed cautious enthusiasm, seeing the sudden spike as an opportunity to revisit their assortments.

Some families plan to have their inherited coins professionally appraised, anticipating hidden value they previously overlooked.

Numismatic clubs report increased membership inquiries, driven in part by stories like Eleanor’s.

Nonetheless, experts advise balanced enthusiasm to avoid impulsive investments based on viral discoveries.

The broader market impact could encourage improved valuation practices and transparency within the vintage collectibles community.

Questions and Answers

Q: Who will be affected by this change?

A: Coin collectors, inherited asset holders, and investors interested in alternative assets may be impacted.

Q: When did the Susan B. Anthony dollar gain this new value?

A: The notable increase in value has occurred over the last two years as collector interest has risen globally.

Q: Why are some 1981 coins worth so much more than others?

A: Rare error coins or those in perfect mint condition are significantly more valuable.

Q: Can these coins be legally sold in Australia?

A: Yes, individuals may sell and trade collectible coins through authorized dealers and auctions.

Q: How should individuals confirm the value of their coins?

A: Professional appraisals by accredited numismatists or certification services are recommended.

Q: Are there risks connected to investing in collectible coins?

A: Yes, values can fluctuate, and not all coins will appreciate equally. Caution is advised.

Q: What role do auction houses play in this market?

A: Auction houses provide a marketplace and credibility to transactions, helping establish market value.

Q: Is there a government body that oversees coin sales?

A: While there is no specific regulator for collectibles, consumer protection laws apply to prevent fraud.

Q: Should coins be kept in certain conditions to retain value?

A: Yes, coins are best kept in protective holders and stored in stable environments to prevent damage.

Q: What can owners expect next in terms of market trends?

A: Continued interest is expected, though growth may stabilize; periodic reappraisals are advised.

Leave a Comment